Navigating Personal Finance with ORT Consulting: Protecting Your Future

In today's fast-paced world, managing personal finances has never been more complicated. From rising inflation to increasing household expenses, financial security can seem elusive. However, having the right strategies in place can provide peace of [...]

Start Your Financial Freedom Now with ORT Consulting

Achieving personal wealth is a journey that requires hard work, dedication, and often the guidance of an expert. At ORT Consulting, we understand that building and maintaining personal wealth does not happen overnight and is [...]

ORT Consulting: Your Partner in Small Business Accounting in Chicago, IL

In today's fast-paced business environment, small business owners are often required to wear multiple hats, juggling various responsibilities to keep their operations running smoothly. One critical area that can often fall by the wayside is [...]

The Importance of Monthly Bank Account Reconciliation: A Guide by ORT Consulting

In the bustling world of business, maintaining accurate financial records is paramount. One critical process that ensures the integrity of these records is bank account reconciliation. At ORT Consulting, we understand the significance of this [...]

Boost Your Business Efficiency with Expert Small Business Accounting Services

In the bustling world of entrepreneurship, small business owners are frequently compelled to juggle multiple roles, from marketing maestro to customer service expert. However, accounting is one crucial area often overlooked amidst these demanding responsibilities. [...]

Elevate Your Financial Management with ORT Consulting’s Expert QuickBooks Services

In the bustling arena of small and medium-sized businesses, efficient financial management is not just an option—it's a necessity. QuickBooks, renowned for its comprehensive features tailored to small-business accounting, has emerged as a game-changer. At [...]

A Top-Down View of ORT Consulting Group: Solving Critical Accounting and Tax Issues with Expertise and Client Focus

In the complex and ever-evolving world of business finance, the importance of expert accounting and tax advice cannot be overstated. Whether navigating the intricate tax landscape or making strategic business decisions based on financial insights, [...]

Navigating the Complex World of Tax Preparation: Why Professional Help Makes a Difference

Tax season is filled with daunting tasks and intricate paperwork for many individuals and business owners. The complexity of tax laws and regulations often leaves taxpayers with more questions than answers, making tax preparation an [...]

Maximize Your Business Potential with ORT Consulting’s Expert QuickBooks Services

Effective financial management is the cornerstone of success in the fast-paced world of small to mid-sized businesses. This is where QuickBooks shines as an indispensable tool. QuickBooks isn’t just software; it’s a comprehensive solution to [...]

Navigating the Complex World of Taxes: The Expertise of Professional Tax Preparation

In today’s fast-paced world, managing taxes can often be daunting for many individuals and business owners. The intricacies of tax laws and regulations are ever-changing, making it challenging for the average person to keep up. [...]

Your Gateway to Streamlined Accounting and Tax Solutions

Located in the bustling city of Chicago, ORT Consulting Group has carved a niche in providing exceptional accounting and tax preparation services to small and medium-sized businesses. With over 30 years of experience, they have [...]

Navigating IRS Reporting: How ORT Consulting Can Secure Your Non-Profit’s Tax-Exempt Status

Non-profit organizations offer an invaluable service to communities, providing aid, resources, and outreach where needed most. However, maintaining the tax-exempt status of a non-profit can be daunting, thanks to complicated IRS requirements. That’s where ORT [...]

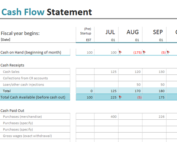

Why Hiring Professional Cash Flow Management Services is Crucial for Your Business

Cash flow management – the two words that can fuel a business owner’s dreams or haunt their financial nightmares. In the dynamic business landscape, keeping a close eye on your inflows and outflows is paramount. [...]

Mastering Personal Financial Planning: The Importance of Accounting in Securing Your Financial Future

Achieving financial security and independence is a universal aspiration, yet many individuals struggle to make ends meet or plan for the future effectively. Personal Financial Planning, a critical component of managing one’s finances, involves strategically [...]

The Compelling Reasons to Hire a Professional Financial Planner

In a world where financial information is freely available online, it’s easy to fall into the trap of thinking that we can manage our finances independently. But the truth is, the world of finance can [...]

Here’s What to Do If You Missed the Tax Deadline

Life happens, and sometimes deadlines get missed. It happens to the best of us, and thankfully ORT Consulting can help you get your taxes back on track. As soon as you realize that you missed [...]

April 18th Tax Deadline

Although it comes around every year like clockwork, tax season still surprises many. It can lead to several weeks of anxiety with trying to gather together documents. Rather than allowing yourself to be inundated with [...]

Biggest Changes this 2023 Tax Season

It is that time of the year again – tax season. Tax season can be very stressful for many Americans. However, ORT Consultants can make navigating tax time a breeze. Our experienced tax professionals can [...]

Tips for Setting Up Non-Profit Organizations

The term non-profit organization is used frequently, but what does it mean? A non-profit organization qualifies for a tax exemption from the IRS when it’s operated for a public, social, or collective benefit as opposed [...]

How to Prep for the Upcoming Tax Season

When tax season rolls around, life can become hectic. To make the process a little smoother, here are some things you can do to prepare as a small business owner. If you need assistance with [...]

Most Common Problems with Payroll Taxes

Businesses of all sizes may have issues when it comes to payroll taxes. The Internal Revenue Service (IRS) is generally not forgiving – leaving businesses on edge when tax season comes around. Still, by understanding [...]

Leave Estate Planning to the Professionals

Estate planning is a critical step in planning your financial future. Without it, you could be opening up your estate to hefty taxes. Multiple heirs or a large estate tends to complicate matters, so everything [...]

Student Loan Forgiveness and Taxes

The question on every graduate’s mind is whether they will need to pay taxes on their student loan forgiveness. The one-time student loan forgiveness will forgive $10k for most borrowers earning under $125,000 annually or [...]

The Inflation Reduction Act and Its Implications for the 2023 Tax Season

Although the 2023 tax season seems like it is far away, it is fast approaching. April 2023 will be here before you know it, so understanding revisions to the tax code now will leave you [...]

IRS Audit Representation: Have the Experts on Your Side

It’s hard to imagine the feeling of dread that is experienced when you open a letter from the IRS stating that you are to be audited. IRS audits are long and drawn out because you [...]

Accounting Services for Small Businesses

Running a small business is the equivalent of working two full-time jobs. Nobody knows your business better than you do, so it is hard to turn over the reigns on certain aspects, such as financials, [...]

Use Bookkeeping Services to Save Money

Small businesses grow over time, which means that your bookkeeping needs must evolve. While you may have started by keeping track of your business finances on your own, you may be in a position where [...]

Summer Tax Deadlines

The 2021 tax season is at an end for many Americans, because April 18th marked the last day to file a 2021 tax return and pay any taxes due. April 18th also marked the due [...]

Small Business Audit Services

Receiving a letter from the IRS stating that your business will be audited is enough to make anyone’s head hurt and your blood pressure rise. After all, about 1 in 100 small businesses are audited [...]

Tax Preparation for Small Businesses

Tax laws change annually which makes it difficult for the average person to keep up with them. Although it may be tempting to file your business taxes yourself, you may be harming your business by [...]

Personal Finances

Personal financial planning is essential in today’s complex economic environment. Creating a personal budget, creating a saving plan and account, setting up tax planning, and addressing debts through the establishment of a debt management plan [...]

New Year Tax Tips

The New Year is upon us and tax season is beginning. While it’s is true that most money-saving options to defer income or accelerate deductions become much more limited after December 31, there are still [...]

Spending Season

Every year on December 25, a large, bearded man flies around the world in his sled pulled by nine magical reindeer to deliver toys and treats to children everywhere. This magical man goes house to [...]

Bookkeeping

Owning and operating your own small business requires a willingness and ability to wear multiple hats. There are always numerous things going on at once and they all require your expertise. It can quickly become [...]

Avoidable Mistakes

Moving from employee to small business owner is one of the more difficult tasks one can undertake. There are many things that new business owners can easily overlook or be unprepared for. There is a [...]

Telecommunication and You

Commuting to and from work is not always the best part of the day. With traffic, accidents, road work, and crazy drivers, commuting can be very frustrating and can produce a lot of stress and [...]

Recovering from a Pandemic

The coronavirus changed the way that a lot of business is done. Unfortunately, there were a number of businesses that did not survive. The world we live in today, with the pandemic still present, is [...]

What is Right for You?

What does a tax consultant do? This is the first question that needs to be asked when looking for someone to help you maximize your financial gains. If you do not know what a tax [...]

The Biden Tax Proposal and You

It is time to see how President Biden’s proposed tax plans will affect you and your family. When President Biden took office, he laid out his plan to fund expanded education, child care, paid leave [...]

Planning Your Future

The world is a volatile place right now. As we start trying to get back to some form of Post COVID normalcy, it seems like everything is touch and go at the moment. What does [...]

COVID 19 and Your Taxes

2020 was a year that many would, understandably, prefer to put behind them. The Coronavirus Pandemic has changed our world in ways that it may never recover from, so the only thing to do is [...]

Quick QuickBooks

It is that time of year – April 15 is right around the corner and it is time to get the necessary inventory, payroll, invoice, and tax filing information together for the accounting department. Small [...]

Make the Most of Your Stimulus Check

The new stimulus package for small business and non-profits is coming soon. While this may be a financial relief to your small business, it is very important that you keep an eye on the fine [...]

Financial New Year’s Resolutions

One of the most rewarding opportunities that we face from one year to the next is the chance to create new habits that will benefit our lives. Yes, I am talking about making New Year’s [...]

A QuickBooks Primer for New Customers

It is not uncommon for financial consulting groups to provide QuickBooks in their breadth of services. If you are new to the world of business and just beginning to find your way through the wealth [...]

Profitable Strategies for 2021

A wise money manager pays attention to their finances on a daily basis – even if they utilize the services of a financial advisor or consulting group. At the same time, it is a good [...]

Suggestions for Increasing Personal Financial Security

The term ‘adulting’ means to adopt habits to help you create and maintain a long-term lifestyle of your choosing while acting responsibly as an ‘adult’. One of the most important actions you can take to [...]

Financial planning is essential for business success

It takes more than good luck to achieve business success: financial planning is the key. It is common to set goals that we want to achieve in the short, medium, and long term. That happens [...]

Why do you need financial intelligence to be successful in business?

To be a successful investor, it takes a lot more than good luck. […]

Retirement and Tax Planning

When planning your retirement income, it is important to remember to factor investment gains and expenses when deciding what type of investment vehicles you want to buy. Sometimes an attractive investment appears to be tax [...]

Personal Financial Planning

Personal financial planning is essential in today’s complex economic environment. Creating a personal budget, setting up tax planning, creating a savings plan and account, and addressing debts through the establishment of a debt management plan [...]

The Basics of Non-Profit Organization Taxes

Non-profit – or NPO or Not-for-Profit (or charity) – organizations are institutions or foundations that dedicate their efforts to and advocate for a particular social cause. According to recent figures there are over a million [...]

Benefits of a Professional Tax Preparer

No matter how many times the tax laws for homeowners and businesses have been simplified, it’s obvious that in a nation of 350 million people with tens of thousands of small, medium and large businesses [...]

Strategy Consulting in a New Decade

With each new decade ushered in, the ability to maneuver the increasingly sophisticated financial terrain becomes ever more challenging. Even half a century ago, startups required nothing more than a garage and some moxie. Now, [...]

A Primer on Financial Statements

Financial statements are the lifeblood of a company. They outline the fiscal health of a business by showing the income taken in and laid out (income statements and cash flow), the outcomes of this activity [...]

New Year’s Resolutions for the Small Business

There are few things that inspire resolve to do ‘better’ in your personal and professional life than the start of a new year. Often, one of the most important commitments is to achieve financial security [...]

What a Small Business Consulting Firm can do for You

There are many examples of entrepreneurs who came up with a great idea and pursued it to success. While focus and good old-fashioned hard work may seem to be all that you would need to [...]

End-of-the-Year Smart Money Moves

Before you immerse yourself fully in the spirit of the holidays, take some time to review your finances and ensure you can enjoy this time worry-free. Here are a few suggestions that should make your [...]

Why Hiring An Accountant For Your Business Is A Good Idea

It might be tempting to try and save money by not hiring an accountant for your business, but having an experienced accountant on your side can keep you a step ahead of the competition. The [...]

Financial Education Begins in Childhood

A basic financial education will give your kids the best chance at a successful and prosperous life. Getting your kids on the path to fiscal responsibility is important, and teaching them how to manage their [...]

Avoiding A Tax Audit

While there’s no way to guarantee that you’ll never be faced with an IRS audit, hiring the tax experts at ORT Consulting can make this unpleasant event less of a possibility. […]

Questions You Should Ask Your Business Consultant

If you are a small or medium-sized business owner you are busy 24 hours a day, 7 days a week and 365 days a year. Business owners eat, drink and breath their company because it [...]

A Primer on Financial Reporting

While business consultants are generally experts in all aspects of accounting, tax services and more, we know that many small and medium-sized business owners are often not as well-versed in the range of financial reports [...]

Business Accounting

If you are a business owner, you don’t need reminding that the accounting end of the business is one of the most important – and one of the most tedious – responsibilities. It is vital [...]

About Financial Services

Financial services companies perform a variety of important roles. They support their clients through financial and investment advising based on their expertise and training. They may also manage, exchange or hold money on behalf of [...]

Tax Time and Financial Services

Americans look at April 15 with disdain at this time of year. But with a bit of explanation you may come to understand the value of an annual review of your taxes with the [...]

ORT Consulting

One of the greatest challenges in life is to keep your financial house in order. It requires attention to detail and focus – both encumbering a large amount of time that you believe might be [...]

Self-Employment Taxes for First Quarter 2019

There are few things more rewarding and satisfying than being your own boss. As an entrepreneur you are able to shape your future in ways that are not possible while in the employment of others. [...]

Get Your Finances In Order for 2019

The end of 2018 is just around the corner. You may not want to think about next year so soon, but getting your finances in order will start off your New Year right. Here are [...]

Lower Your Taxes and Boost Your Investments

No one likes to pay high taxes and if you play your financial cards right, you can reduce what you owe each year. There are a few basic steps almost everyone can take to reduce [...]

Give Yourself A Gift – Lower Your Tax Liability

The tax laws passed in 2017 could save you plenty of money if you know what to do now. There’s a way for everyone to save, so read on for some of the best ideas [...]

Budgeting for the Holidays

You’ve worked hard all year keeping your budget on track. Don’t derail it when the holidays roll around. Retailers make the most money of the year during the December holidays, but that doesn’t mean you [...]

What to Look for in a CPA

Are you an entrepreneur? A small, mid-size or large business owner? No matter where you settle on the continuum of conducting business, you are likely going to need a certified public accountant. There are only [...]

Paying Taxes as a Freelancer

The number of businesses who hire freelancers is growing every year. Generally speaking, it’s a win-win for both parties. Employers reduce the cost of benefits, pay for services only when needed, and can select from [...]

What The Fiscal Year-end Means For Your Business

The fiscal year-end is the conclusion of a 12-month accounting cycle. A fiscal year can be the same as a calendar year, from January to December, or it can begin and end at any time, [...]

Surviving A Tax Audit

You've filed your income tax with the IRS and breathed a sigh of relief; then you're notified that you're being audited. If the IRS taps you for an audit, don't panic. While you don't have [...]

Put Your Tax Refund To Work For You

As tax time rolls around, many people look forward to getting a tax refund. Their first thought is often, “how can we spend it?” This year consider saving your refund instead of spending it. Over [...]

Three Steps To Make Filing Your Taxes Easier

Every April 15th, the tax man comes knocking. If you’re like many Americans, it’s also the time for stress as you rush around trying to find misplaced receipts and pay stubs. Start now and stop [...]

How To Get Your Clients To Pay On Time

The cash flow is the lifeblood of any business; it gives business owners the means to buy the goods they sell and pay their employees. For many small businesses, uncertain cash flow can hold them [...]

Productivity Hacks For Small Business Owners

Business owners and managers need to be efficient to make the most of every opportunity that comes their way. Here are some hacks that small business owners should consider to boost their productivity: Take Advantage [...]

Tips For Better Cash Flow Management

without a reliable process for tracking and collecting payments will eventually find it difficult to turn their revenues and profits into cash flow. One in four businesses fail because of interruptions to cash flow. Don’t [...]

Common Small Business Accounting Mistakes To Avoid

With widely available accounting tools, it is now easier than ever to keep an accurate record of where your company’s money is going. However, there are still possibilities of committing errors and accounting mistakes. While [...]

Keeping Your Small Business Finances In Order

Keeping your business finances in order is crucial because it can help you project your business’ growth, determine how your earnings and expenses stack up, and make informed decisions. Managing finances, however, can be difficult [...]

Is Canceled Debt Taxable?

Basically, even cancelled or “forgiven debt” from a lender is still taxable income, according to the IRS. As such, it must be included as income on your tax return. Debts which you are personally responsible [...]

Elder Care and Support

As your family members get older they may need some help with day-to-day tasks. One of those tasks may be helping with their finances. Even ordinarily tasks, such as balancing a checkbook or paying bills [...]

What the “GAAP” Does

If a company releases its financial statements to the public, it is required to follow Generally Accepted Accounting Principles, called GAAP, in the preparation of those statements. “GAAP” consists of three important sets of rules: [...]

What an Accountant Does

“An Accountant counts money!” says Mr. Joe Average; and he’s not wrong. But accountants do a lot more than just “crunch numbers”. Accountants deal with a wide range of finance-related chores that involve figures and [...]

Social Responsibility in Accounting

Money is a great motivator, which is why financial reports exist. Financial reports must contain truthful and unbiased information, and accountants must create unbiased and accurate financial reports for those who deal with finance in [...]

Bridging the GAAP

Financial reporting means balance sheets, profit and loss statements, financial notes, and disclosures, and it has its own language. It’s the language used to communicate information about the financial condition of a company, be it [...]

Basic Principles of Accounting

These basic principles form the basis which modern accounting is based. The best-known of these principles are as follows: The Accrual Principle: The concept that accounting transactions should be recorded in the periods when they [...]

Accounting Principles

Accounting principles are the rules and guidelines that companies must follow when reporting financial data. American accounting principles are defined as Generally Accepted Accounting Principles (GAAP). Companies must regularly file financial statements according to GAAP [...]

Accounting for Dummies

Businesses get the money; Accountants keep the books. Accountants keep businesses, governments and “not-for-profits” groups working by following systematic methods of recording their financial activity. […]

Accounting as a Career

Public accounting offers a varied career path. The duties of an account will depend on the size of the firm , and is generally a “partnership” In a small firm, one may work on business [...]